Investing in a Renewable Future

Expertise in EV batteries and passion for investment led Hansol Kim ’03 to launch a new private equity firm

Many CRMS alumni graduate with a deep appreciation, and often a strong passion, for stewarding the environment. Over the years, the influence of the Outward Bound program and Leave No Trace principles resulted in countless alumni studying environmental science, working in nature-focused nonprofits, and of course, summer jobs in National Parks and National Forests around the US. Hansol Kim ’03 fits this perfectly – if you’re thinking about the investment side of things.

Many CRMS alumni graduate with a deep appreciation, and often a strong passion, for stewarding the environment. Over the years, the influence of the Outward Bound program and Leave No Trace principles resulted in countless alumni studying environmental science, working in nature-focused nonprofits, and of course, summer jobs in National Parks and National Forests around the US. Hansol Kim ’03 fits this perfectly – if you’re thinking about the investment side of things.

“During my third year at the University of Chicago, I took a class related to climate change which helped me learn the impacts of increasing carbon emissions,” says Hansol, who lives in Silicon Valley. “Many of the reasons for the exponential growth in carbon emissions were caused by actions we are taking as humans. I wanted to take part in solving this problem, and it eventually led me to choose my first job in the electric vehicle (EV) battery business.”

Born in Suwon, South Korea, “a lovely city near Seoul,” Hansol was raised in a large extended family of grandparents, aunts and uncles, parents, and a younger brother. “Growing up, my parents always had my brother and me exploring new things. This included summer exchange programs in the US, mountain biking with dad on weekends, skiing when it wasn’t as popular in Korea as it is now, and hiking trips across the Korean Peninsula. With all these trips and experiences, when I reached junior high, I told my parents that I wanted to study in the US either for high school or college, and that’s when we started looking at options in the US.”

When joining CRMS as a sophomore, Hansol says he learned the lifelong lessons and principles he lives by today.

“I am so grateful for the interactions and relationships that I had with the teachers during my time in Carbondale,” he says. He couldn’t pick a favorite class, pointing to “Kayo’s geology field trips, Lynn’s yearbook crew, Jim’s chemistry experiments, Dave’s American government, Julie’s art sculpture, and George’s music class. I can still remember the smell, the feeling, the excitement, the discussions, and the voices of each teacher and classmate. Living with most of them on campus made them much more than teachers and school friends; we were family in Carbondale. They all gave me lessons that helped me become the person I am now.”

After graduation, Hansol headed to the University of Chicago, wanting the experience of a larger US city with a lot of diversity and, among other things, a great basketball team. “Since I was a little kid, I loved basketball and grew up watching the Chicago Bulls,” he says. “I naively thought I could meet Michael Jordan if I moved to Chicago!”

Hansol didn’t cross paths with the NBA legend and, in fact, halted his education after his second year to return for mandatory national service in the South Korean military.

“It is not easy for anyone to pause your college education for two years and go back to your country for military service,” reflects Hansol. “Every guy in Korea has the obligation, and I proudly served my time; it is an honor to spend two years protecting your country, your family, and fellow Koreans.”

“This was also the time that I read a lot. From Herman Hesse’s books to Chinese 101 to books on climate change, I learned a lot from the books I read and developed ideas on my path after my military service. Over time, I gradually developed my interest in climate change,” he says, noting that it led to selecting the course when he returned to Chicago that piqued his interest in the finance side of renewable energy.

His first position in the sector was with LG Energy Solutions in Korea, where he developed his expertise in the EV battery business. Later, he joined Electrify America, helping the company set up the largest EV charging infrastructure network in the US. Following this, Hansol moved to Apple, working on developing the company’s supply chain strategy, utilizing his industry expertise in key EV technologies like lithium-ion batteries.

Earlier this year, Hansol decided to go all in on his passion for EV and battery technologies and founded Bricks Capital Management (brickscm.com), a private equity investment firm that specializes in partnering with businesses in the EV battery and mobility technology sectors. A key motivation? According to the EPA, the transportation sector is responsible for 27% of total greenhouse gas emissions in the US. Hansol wants Bricks Capital Management to be part of the solution to this climate dilemma.

“EV and mobility transformation will be one of the biggest areas that can help tackle challenges associated with climate change. We try to find companies and partnerships that will be the most impactful. Brick by brick, we will strive to help make our world a safe, clean, and sustainable place to live.”

The recent passage of the Inflation Recovery Act, which includes transformational legislation around climate change and renewable energy domains, is particularly auspicious for Hansol’s new firm. Among its goals is the creation of a more positive and supportive environment for the renewable energy and EV sector.

“Mainly, the important part of that law is what it does to establish a domestic battery materials supply chain. If you want to electrify the majority of transportation, you don’t need just batteries but all of the raw materials and manufacturing equipment needed to make those batteries. Manufacturing-wise, we need to establish a sufficient battery supply chain in the US. So a big part of the new law help companies develop technologies and create a supply chain in North America.”

“Think of it: if 30-40% of our cars are electrified in the US, that’s a massive amount of battery materials, and we can’t rely on just the foreign-sourced material since 50-to-60% of the cost of an EV battery is in the raw materials. We also need to develop a battery recycling process so that we can use those raw materials again. This new legislation incentivizes this. The government can’t do this alone; it has to be coupled with private investments and partnerships, and that’s where we can fit in.”

“For me, it’s something we’ve been waiting for in the US, and it has huge implications,” Hansol continues. “The government support and initiatives are critical to building up an industry on such a large scale. Other global competitors can move fast because of their government’s support coupled with private investment. We want to play the part of the private investor to accelerate that change. Together, it can lead to improvements in our daily lives.”

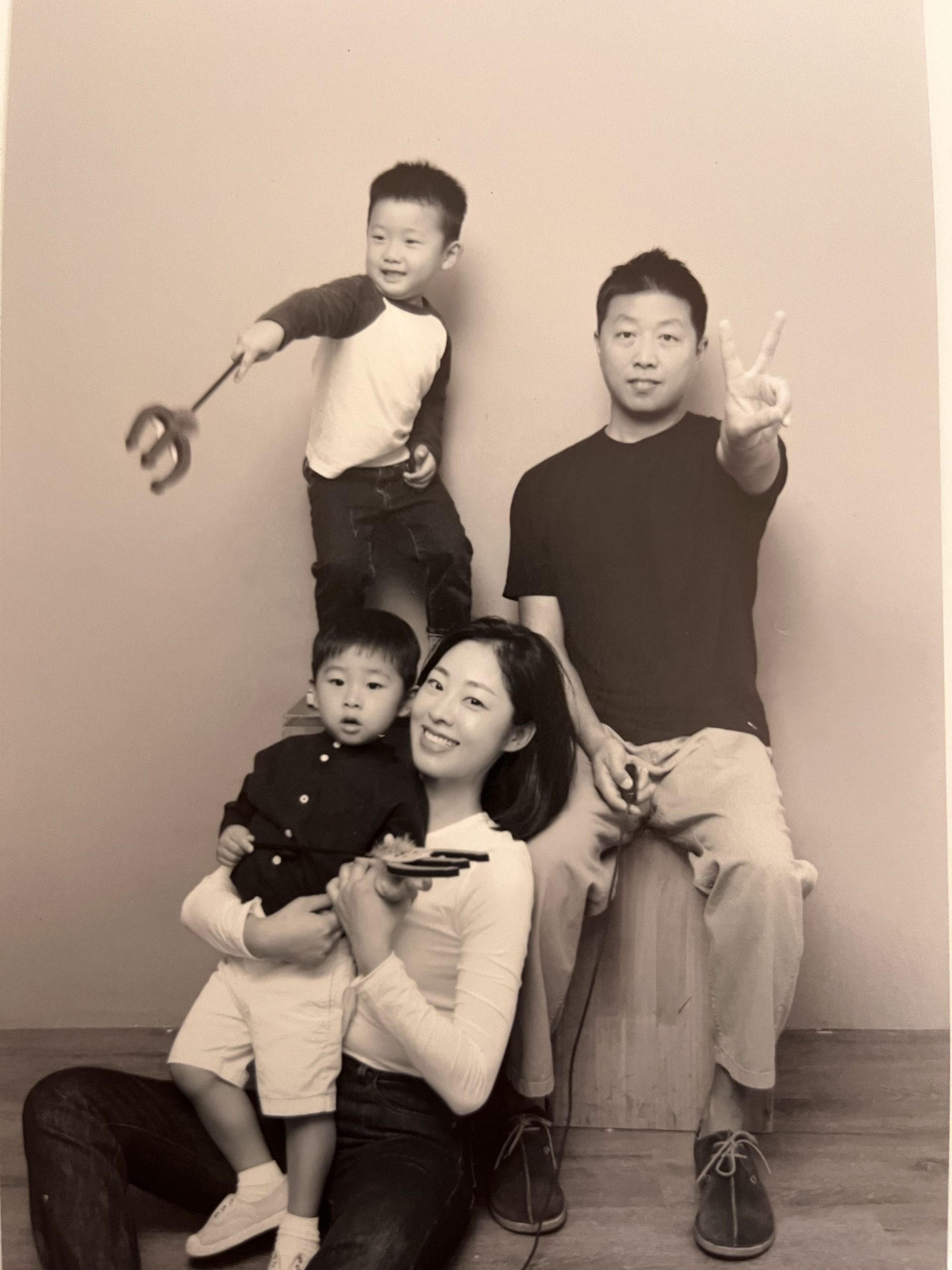

When he reflects on his three years at CRMS, Hansol not only began to appreciate the natural environment that drives his professional passion but also for finding balance in life between work and play. He says that it helped him build a foundation to stay healthy by actively engaging in outdoor activities, which he enjoys sharing with his wife, Heajung Kang, and sons Eine (five years old) and Leo (three years old).

When he reflects on his three years at CRMS, Hansol not only began to appreciate the natural environment that drives his professional passion but also for finding balance in life between work and play. He says that it helped him build a foundation to stay healthy by actively engaging in outdoor activities, which he enjoys sharing with his wife, Heajung Kang, and sons Eine (five years old) and Leo (three years old).

“Always stay curious” is his advice to CRMS students starting their high school career this fall. “Follow your instincts and invest your energy into something that truly moves you. Learn to be patient. Great outcomes will only come with time, consistent effort, and focus. Find your own ways to build muscles both mentally and physically to stay curious and to maintain focus.”

MYCRMS

MYCRMS

Virtual Tour

Virtual Tour